Company Car Tax Explained

When it comes to business leasing, one of the main considerations for business owners, fleet managers, and the driver of the vehicle, is company car tax.

Also known as Benefit-in-Kind (BiK), it's a tax that's primarily based on a car's CO2 emissions, leading to the increased popularity of hybrid and electric cars as company cars.

Here is our easy-to-digest guide to what company car tax is, what is means to the driver and the company, and some of the tax incentives offered to businesses.

- What is company car tax?

- How is company car tax calculated?

- What are the BiK rates?

- What is the difference in tax between business and personal leasing?

- Costs and benefits to the employer

- Company car tax for electric vehicles

- Key considerations when leasing a company car

- What you should discuss with your employer?

"Company car tax is designed to encourage drivers to choose cars with lower levels of CO2 emissions, with incentives offered to both the company and the employee."

In the UK, company car tax is essentially the government’s way of ensuring that benefits like a company car don’t go untaxed, as they’re considered part of your income.

Company car tax is a tax based on a car's emissions and on a percentage of the vehicle's official price (P11D value), and other factors like how the car is paid for and when it's used.

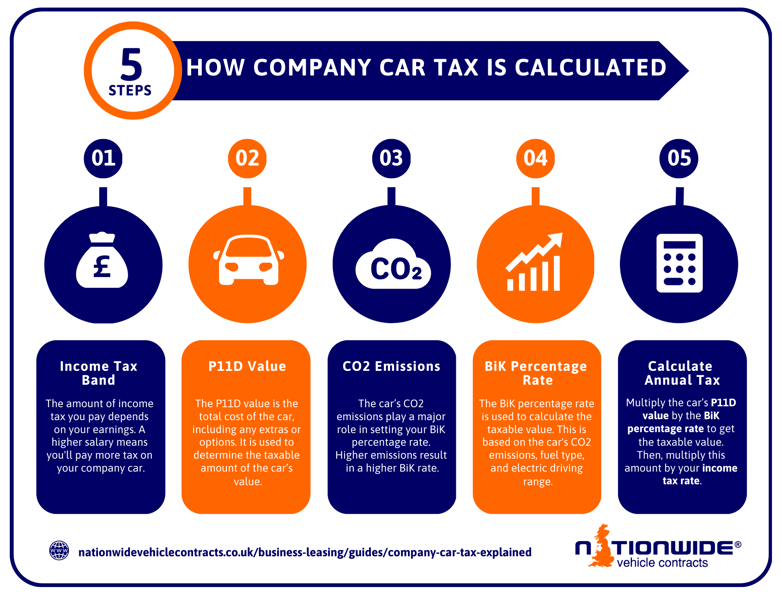

This is one of those questions that is pretty tricky to wrap your head around, as there are so many variables. BIK rates for each model vary depending on factors such as your tax bracket, the list price of the vehicle (P11D value), and CO2 emissions.

If you want to calculate it yourself, you will need to multiply the P11D value by the BIK percentage banding, then multiply this by your tax band (either 20% or 40%). To then get your monthly outgoing, divide this by 12.

Your high school maths lessons are no longer going to waste - well done!

- P11D value - This is the car’s full list price, including VAT and any additional features. Think of this as the baseline taxable value for your car.

- CO2 emissions - Pretty simple here. The lower your car’s CO2 emissions, the lower your company car tax rate will be, hence why electric cars are a popular company car choice.

For example, if a car’s P11D value is £30,000, multiply this by the tax rate applicable to its CO2 emissions (e.g. 10%), and you’ll get £3,000. Then multiply this by your personal tax rate (20% or 40%). If it’s 20%, you’ll have an annual company car tax of £600.

Alongside normal taxes such as vehicle excise duty, BIK rates are important to the driver of the vehicle. As they are primarily CO2-based, BIK rates have contributed to the significant rise in the number of electric and hybrid vehicles being used as company cars.

The Chancellor sets BIK rates, and in the most recent autumn budget announcement (2024), they announced that the new rates will continue to incentivise the uptake of electric company cars.

The most notable information was that BIK rates for zero-emission vehicles will increase for 2028/29 and 2029/30 by two percentage points - taking them to 7% and 9% respectively. Plug-in hybrids will also see a rise, while all other bands will increase by a point, capping at 39%.

Here are the current BIK rates as of October 2024:

Vehicle CO2 (g/km) | Electric range | 2024/25 | 2025/26 | 2026/27 | 2027/28 |

|---|---|---|---|---|---|

0 | N/A | 2 | 3 | 4 | 5 |

1-50 | >130 | 2 | 3 | 4 | 5 |

1-50 | 70-129 | 5 | 6 | 7 | 8 |

1-50 | 40-69 | 8 | 9 | 10 | 11 |

1-50 | 30-39 | 12 | 13 | 14 | 15 |

1-50 | <30 | 14 | 15 | 16 | 17 |

51-79 | 15-20 | 16-21 | 17-21 | 18-21 | |

80-99 | 21-24 | 22-25 | 22-25 | 22-25 | |

100-129 | 25-30 | 26-31 | 26-31 | 26-31 |

NOTE: This table has been clustered for the purpose of this guide. BIK rates will vary depending on their specific CO2 emissions.

While personal leasing is similar to business leasing in many ways, the biggest difference is that you are able to claim up to 100% of the VAT back on a business car leasing. If the vehicle is also being used for personal use (subject to permission given by the employer), you can claim up to 50% back on VAT.

You cannot use a personal car lease for business purpose so keep this in mind when looking for a car lease.

Because BiK is, as the phrase suggests, a benefit to the employee, the employer is liable to pay Class 1A National Insurance Contributions (NICs) to reflect this, with the Class 1 NICs based on the vehicle's P11D value and relevant BiK rate which is determined by the official CO2 emissions and fuel type.

Nowadays, electric vehicles dominate the company car market. They are not just environmentally friendly and great vehicles to drive, but as stated above, return significant tax advantages for the employer and employee.

Electric cars come with a much lower BIK rate and, as stated in our Top 10 company cars guide, will often have an annual tax rate of below £400. This is significantly lower than the rates for a petrol or diesel car.

For example, if you’ve got an EV that has a value of £40,000, after applying the 2% BiK rate, your taxable benefit is just £800. If you’re a 20% taxpayer, this means an annual cost of just £160 for your company car!

So, you’ve decided you like the sound of a company car. Here’s what to consider to ensure you get the best lease deal possible:

- Emission levels - This is the most important factor when leasing a company car. Lower emissions mean lower BiK rates, which significantly reduce your tax bill. We would recommend going for an electric or hybrid vehicle.

- Lease terms - Ensure you understand the lease terms you are signing up for, including mileage, maintenance, and the wear-and-tear policy.

- BiK rates - Whenever there is a budget announcement, BiK rates tend to be a hot topic of discussion. Keep that in mind as the information may change annually.

- Personal vs business use - BiK tax applies to personal use of a business gift. If your car is solely used for business, you could be exempt from BiK tax.

Before setting up a company car lease, here are some things to discuss with your employer to ensure you’re making a good decision:

- Tax band considerations - The higher the tax band you’re in, the higher your BiK tax. Ensure you discuss cars that fall within your budget.

- Salary sacrifice schemes - Some companies offer a salary sacrifice scheme, which is when an employee sacrifices part of their monthly salary in exchange for a non-cash reward such as a car. The cost of the lease is taken before you pay tax, thus reducing the amount of income tax and national insurance you pay.

- Expense policies - Find out if your company reimburses fuel for personal use or if they have any specific car policies you have to abide by.

If you’re after more information on leasing a company car, check out our comprehensive range of business leasing guides.

We also have special offers for businesses looking to lease a car through a contract hire agreement. Take a look at our business leasing section for more information or call us on 0345 811 9595.

Guide Information

Originally published: 14th April 2021

Last updated: 15th November 2024