If you’re thinking about leasing a car or van for the first time, chances are you’ve got quite a few questions about how the finance side of things works.

Within leasing alone, there are plenty of finance options to think about – and that’s before you compare these to buying a car outright.

There’s no single correct answer about what option is right for you. Your best bet is to get a complete understanding of what your different finance options are so you can make a fully informed decision.

In this blog, we'll take a look at what your options are, the sort of financial information you'll be asked to provide, and other common questions.

We discuss:

- What are the different finance options available for leasing?

- Are there any differences between business and personal finance?

- Why does my credit need checking when leasing a vehicle?

- What is a good to excellent credit score?

- What information will I be asked to provide?

- Can someone else take out car finance for me?

- What happens at the end of the contract?

Vehicle leasing is basically a long-term rental agreement: you make an initial payment on the car or van, and then make a series of fixed monthly payments for the duration of that contract. It’s another way to fund having a new car, without needing a bank loan, for example.

Under the leasing umbrella, personal and business customers have a range of different finance options – otherwise known as contract types.

Here's all the options available to you:

Personal Leasing

- Personal Contract Hire - A long-term rental where you pay monthly payments for the duration of your contract, then return the vehicle at the end of the agreement.

- Personal Contract Purchase - After an initial deposit and series of monthly payments, you have the option to purchase the vehicle or return it to the finance provider.

- Personal Lease Purchase - When taking out the lease agreement, you agree to purchase the vehicle at the end of the contract. Note, this is no longer available with Nationwide Vehicle Contracts.

Business Leasing

- Business Contract Hire - Your business pays fixed monthly rentals for the duration of the contract and at the end, returns it to the finance provider.

- Business Contract Purchase - You follow all the usual steps to leasing a vehicle, but at the end of the contract, have the option to buy the vehicle for your business.

- Finance Lease - You pay either the entire cost of the vehicle (including interest) or lower monthly rentals with a final payment based on the resale value of the vehicle. It offers significant tax advantages.

Plenty to choose from! Check out our video below, which provides a run down of the advantages of leasing a car:

Yes, there are. As the name suggests, personal leasing contracts are designed for private individuals. If you're planning to lease a vehicle as a limited company, partnership, sole trader or LLP, business leasing is likely to be more appropriate.

Some of the key differences between business and personal leasing are as follows:

- Available contract types - Finance lease is only available to business customers. Private individuals can choose between personal contract hire and contract purchase.

- Necessary financial information - Private individuals need only provide financial information about themselves. If you’re a business applying for a lease contract, you will be asked to provide information about your company and its finances, as well as personal details.

- Tax benefits for businesses - For example, on a business contract hire agreement, you can reclaim up to 50% of the rental for cars, or up to 100% on commercial vehicles.

For more details, check out either our Personal Leasing Guides or our Business Leasing Guides.

When leasing a vehicle, whether as a private individual or as a business, you are effectively borrowing the money from a finance company to pay for the car or van. Therefore, you will need to undergo a credit check as part of the finance application process.

Finance providers use this information to determine whether you meet their criteria for the credit agreement in a similar way as if you were applying for a loan. Most funders will ask for a good to excellent credit score.

If your credit history is poor, you may find that your application is declined, or that certain conditions are placed on your contract.

Funders do this to help judge whether you will be able to meet your leasing payments. This is in your best interests too: if you default on your leasing agreement part way through, the finance company may be able to take the car from you. Missing payments can also leave a bad mark on your credit profile.

Most funders will not accept you for vehicle finance unless you have a "good" to "excellent" credit score. According to Experian's credit score system, this is the equivalent of a credit score of 881 or more.

It's worth noting that no lender uses your credit score alone to approve or decline you finance, other factors such as income and other debts come into play. However, credit score does play a big role, and it's best to have as good as score as possible.

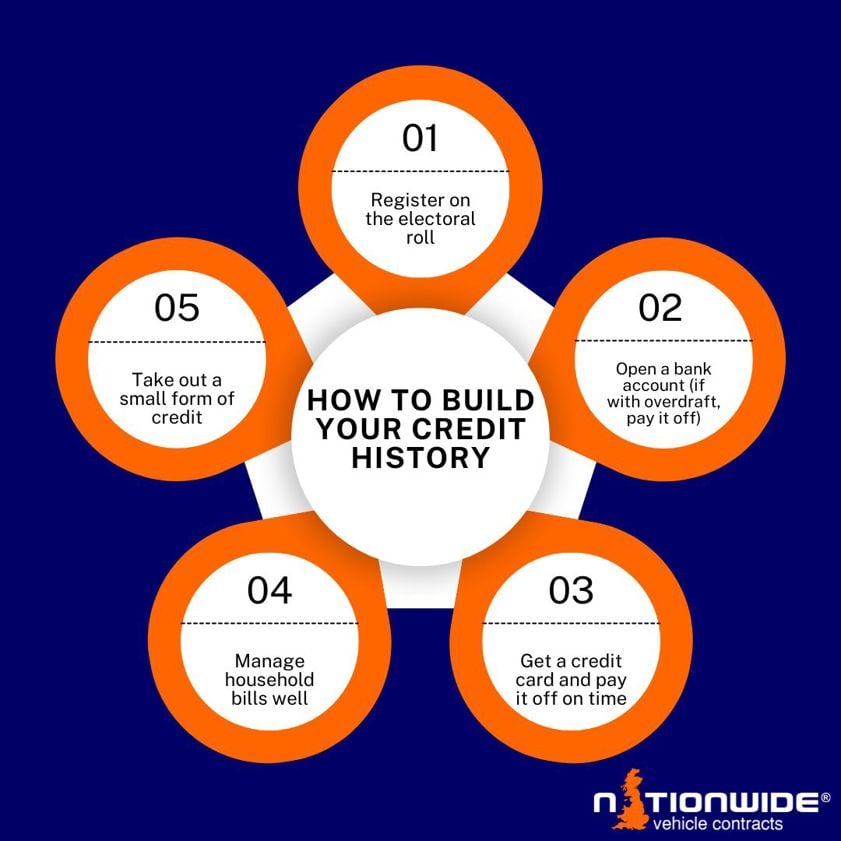

Here's some quick advice to building up your credit history:

As part of your finance application, you will be asked to supply various pieces of information. The information you will need to provide depends on whether you are applying to lease as a private individual or a business.

Personal customers:

- Personal details, e.g. marital status and number of dependants

- Address details for the past five years

- Employment details for the past three years

- Bank details

- Monthly income and expenditure

- You might also be asked for further detail about your employment history or your monthly income and expenditure

Find out why this information is needed – and if you’re likely to be eligible for personal finance – in our guide to personal finance eligibility.

Business customers:

- Company details

- Director details

- Business bank details

- You might also be asked for three months’ business bank statements, management accounts or for a director’s guarantee

Find out why we ask for this information – and whether your business is likely to be eligible for finance – in our guide to business finance eligibility.

The short answer is no.

If the leasing company has declined your finance application, it’s likely to be because they deem you too high risk to loan money to.

If you’ve been declined car finance, you might be tempted to ask someone else to apply on your behalf. This is what is known as an accommodation deal and is strictly forbidden by finance providers.

None of us like bad surprises, especially if they're related to our finances. When your lease agreement comes to an end, it's essential that you understand the financial implications relating to fair wear and tear and mileage.

Fair wear and tear

When you return your lease vehicle, it will be inspected for any damage that falls outside of 'fair wear and tear' guidelines. If any damage is found, you will be liable to pay for this in the form of end-of-lease penalty charges.

In 2020, the average fair wear and tear charges cost an average of £326, emphasising the importance of keeping your lease vehicle well maintained for the duration of your contract.

To avoid this, the first step is to obviously conduct regular upkeep on your vehicle. This includes interior and exterior cleaning and regular servicing and maintenance.

Mileage

Excess mileage is often forgotten about but can be costly when it comes to the end of your lease agreement. When you sign for a lease vehicle, you agree to a set mileage, and anything above this will cost you in excess mileage charges.

Charges range from finance provider to finance provider but typically range from around 3p to 30p per mile.

For more information, check out our guide Excess Mileage Charges Explained.

Originally posted: 21st November 2024